Women and Finance

This is part of a sponsored collaboration with Prudential and DiMe Media. However, all opinions expressed are my own.

Looking at me on social media, you would never know how difficult my life is. We all tend to put our best foot forward, right? We feel that if we present the "realness" folks may not like what they see and if you're in the public eye, perhaps sponsors will shy away from your brand. At the many networking events I attend, they stress presenting your authentic self. I have to admit, I am afraid to present this side of me but when I went to the Prudential/DiMe Media 'Women Inspired' San Diego event last week and heard all the beautiful stories shared by the women on-stage and in the audience, it encouraged me to face my reality. If my story and past can help another, like these ladies helped me, then that's what I will do. So buckle up, and get ready for a whopper of reality. My reality!

Teen mom: I had my daughter shortly after graduating high school. I was in my 1st semester of college living with my high school sweetheart, barely able to care for myself and now we were caring for a newborn.

Special-needs mom: as if having a baby at such a young age while in college wasn't enough, my sweet baby girl was diagnosed with a genetic disorder. We noticed all her developmental milestones were delayed and she was underweight. It took many years for science to catch up to an actual diagnosis but she is 1 in 4 people IN THE WORLD with this rare disorder. It affects her mentally, physically and socially. Life is hard for her but she tries her best.

College Graduate: While my daughter was graduating special-ed kindergarten, I was graduating with my Bachelor's degree in Nursing. Eager to start my new career as a RN, I wasn't excited to pay back all the student loans I acquired during my years pursuing my degree.

While in my first year of nursing I had another child, this time a boy. Our family of four was now on cruise control as we starting looking for our first home to raise our children. But sadly we would never get there as my children's father passed away in a terrible accident.

Y'all still with me?

Young Widow: At 29 years of age and a mom of two I was now facing the devastating loss of my children's father. Emotionally, physically and financially, losing someone is quite possibly the worst pain I have ever felt.

Effecting Change "Aha" moment

When the funeral services were over and family and friends slowly stopped coming over reality kicked in and I realized I am left to raise two children on my own. There is something that came over me realizing that I was the only parent left to provide for my children was a real rude awakening. If something happens to me, my children will be alone. Alone!! Who would be there to care for them and prepare for their future? It was time to get serious.

Let that sit in for a moment.

Financial Challenges While some of my friends were celebrating their big 3-0 birthdays clubbing, traveling to exotic spots, I was making financial plans for my children and I. I bought my first home and was assigned a financial planner through my employer who helped me get my 401K, life insurance plan, and their 529 college savings plans in order. I felt so proud of myself. I kept thinking I was doing everything I could to prepare for my future, but more importantly, for my children's future.

I felt good that I had all this in place and as the years passed, life was finally on a good path. I fell in love, married and had 2 more children. We were now a family of 6.

I wish I could say that's where the story ends but it wouldn't be mi vida loca if it did.

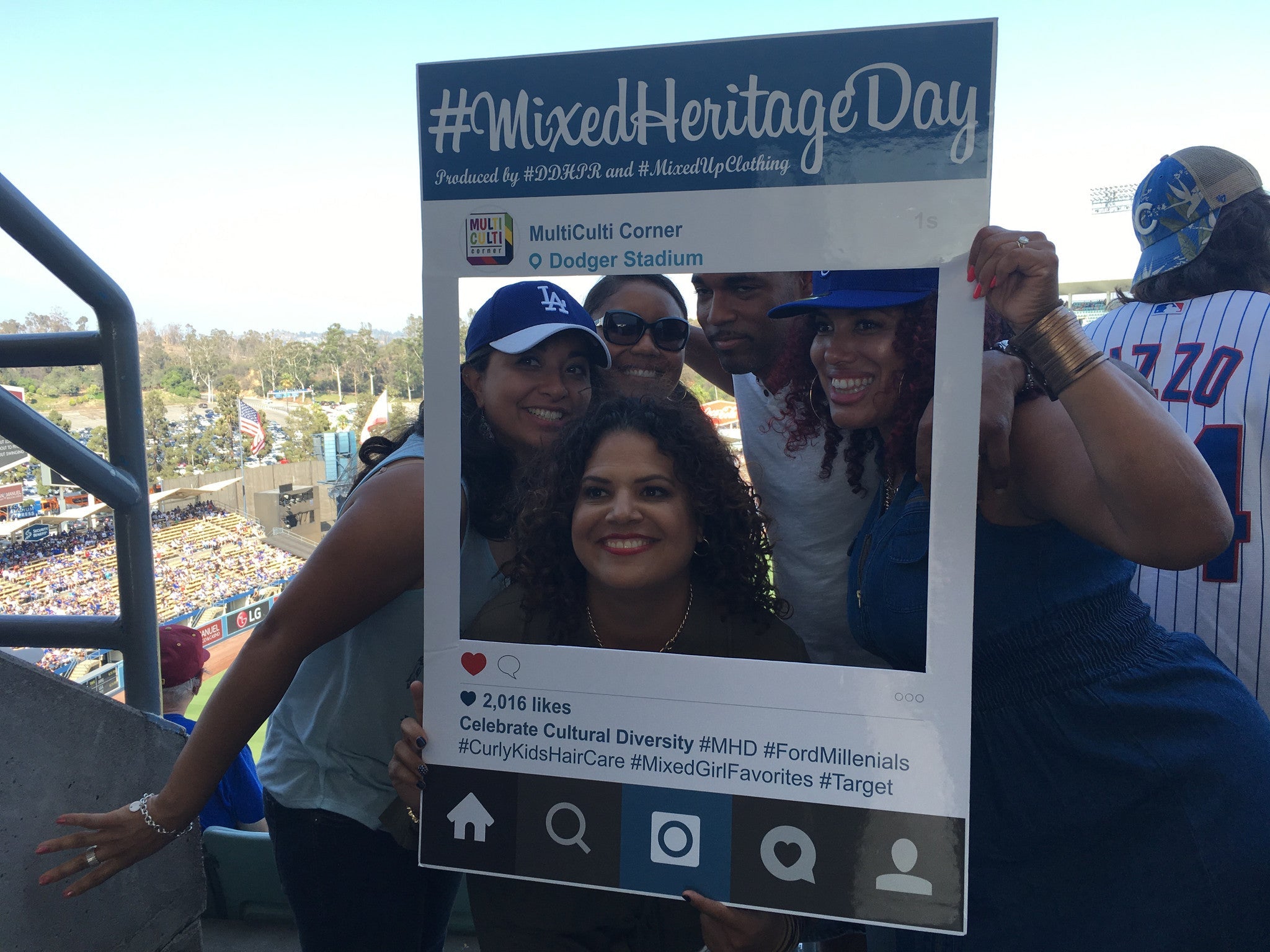

As I was working as a critical care RN my life's mission and entrepreneurial spirit led me down another path. Taking the approach of "life is too short" I started a small business, Mixed Up Clothing. With the help of my grandmother and (sadly) borrowing against my 401K I started my company and have not looked back.

This little company has taken me on the journey I would never have predicted for myself but it has taken all the money I saved for my future and now I need to get back to investing in my business, myself, my spouse and my children.

Future Plans Being at the Prudential/DiMe event, I walked away with action items and a to-do list of what I'm going to do to work towards retirement and invest in my legacy.

They are:

1. Find a financial planner I trust

2. Research the various options out there that meet my needs. Each person and their circumstances are different. What suits one may not suit another. I will discuss with the planner and find the best one for us that address my needs:

A. I have a special needs daughter

B. I have a senior in high school so college savings is pressing.

C. Elderly grandparent and parents I want to help

3. Business- I want my business to continue long after I'm gone so how do I navigate that process in preparing a legacy.

4. Retirement- umm, yea one day I would like to retire

So there you have it. Here I am flaws and all. I don't have a pretty life story. I have had tragedy after tragedy and guess what? I'm still standing. I learned I am stronger than I ever thought I was and that I can do anything I set my mind to.

I will get back on financial track because I owe it to myself and my family.

1 comment

I relate to your hesitance to share the “real you” on social media or elsewhere. It’s a confusing time to be a female entrepreneur. I happen to be over 50, which is another story altogether when it comes to starting over in the professional arena. I doubt there is a male counterpart to this type of forum. We’re at a crossroads in terms of our roles at home and in the ever-changing world of business. Our identities are up for re-definition and I welcome the changes but admit it’s a challenging time. I want to be authentic AND successful, but the facts that: I’m female, I’m over 50 and I’ve faced a lot of grim challenges that no one would imagine (and am still dealing with them) fuel my best editing skills when I’m deciding what to post. I don’t have a lot of time left to reach my goals but I have so much to share! Thank you for sharing your experience and passion!

Shannon Vergun

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.